Separated? Wanting a Fair, Amicable Financial Settlement?

Book Your “Family Separation Pathway Consultation” with Sunshine Coast’s Top Financial Settlement Family Lawyer

Smooth, quick, and efficient financial family law settlement

Robust, and claim-proof agreements

End-to-end support, from final agreement to property transfers and children matters

The Unspoken Truth About “Fair & Amicable” Financial Settlements

Dear Separated Couples,

You're here because what you want is simple:

Divide your assets fairly and move forward with your life without the emotional and financial drain of a bitter legal battle.

But…

You’re wary of hiring the wrong financial settlement (family) lawyers to help you with this amicable financial separation. You’ve heard the horror stories:

❌ Antagonistic lawyers who encourage more conflict than necessary. Some deliberately prolong disputes—all to increase their billable hours at your emotional and financial expense.

❌ Legal fees spiralling out of control. We've seen cases where $280,000 of the $750,000 equity in the house went only to legal fees – leaving both parties significantly worse off.

❌ Initial agreements that fall apart. Without a formal division of assets and proper finalisation, “amicable” situations get messy fast. Why? Simple. The Law does not recognise informal family law separation agreements.

But here’s the good news:

Your financial separation doesn’t have to be this way.

At Baldwins Lawyers, we've created a different approach focused on protecting your assets, securing your future, and helping you move forward with dignity.

✅ Our streamlined process means you could finalise your separation quickly and efficiently.

✅ Our settlements are legally binding and meticulously crafted to withstand future challenges.

✅ We handle everything from negotiating the final agreement to property transfers and children's matters – all under one roof.

If any of this sounds good to you, I invite you to read on.

This page shows you why we’re not like any other financial settlement lawyers on the Sunshine Coast.

Plus, it also details what you can expect when you work with us and how to book your private “Family Separation Pathway Consultation” in which we’ll listen to your unique situation, outline clear options for moving forward, provide transparent costs and timelines, and answer all your questions in plain, jargon-free language.

To a Peaceful Fresh Start,

Smooth, Quick, and Efficient Settlements for Separated Couples Who Want a Peaceful, Fresh Start

Baldwins Lawyers is a leading family law firm on the Sunshine Coast. We’re the right fit for you if…

✅ You want a fair and amicable resolution

You believe in ending your relationship with dignity and respect, not bitterness and conflict, especially when children are part of the equation.

✅ You're ready to move forward with your life

You want to close this chapter and begin your new one instead of being stuck in legal limbo for years.

✅ You need protection from future financial claims

You seek peace of mind knowing that once settled, your ex-partner cannot come back years later asking for more.

✅ You love clarity and straightforward communication

You're tired of legal jargon and want to understand exactly what's happening at every stage of your settlement.

✅ You want to preserve your hard-earned assets

You don't want to see your assets consumed by excessive legal fees. You want to ensure your wealth stays with you and your family, not your lawyers.

✅ You want a lawyer who handles all aspects of your separation

You want a service that handles all aspects of your separation, from financial settlements to property transfers and children's matters.

Why Baldwins Lawyers is the Best Decision You’ll Ever Make for Your Future

| The Baldwins Experience |

|

|

|

| Property Transfers Included |

✅ Guaranteed |

❌ Once settlement done, you're on your own |

❌ |

| Children's Matters Handled |

✅ Guaranteed |

❌ You’re forced to hire separate lawyer |

❌ |

| Legally Binding Agreements | ✅ | ✅ |

❌ Templated agreements that courts can overturn |

| Plain Language Communication | ✅ |

❌ Drowning in confusing legal jargon |

❌ |

| Strategic Pressure When Needed | ✅ |

❌ Passive approach lets cases drag on |

❌ |

| Emotional Support Throughout | ✅ | ❌ | ❌ |

| Quick Resolution Process | ✅ | ❌ | ❌ |

| Clarity on Your Entitlements | ✅ | ❌ | ❌ |

| Single Point of Contact | ✅ | ❌ | - |

| Transparent Fixed Pricing | ✅ |

❌ Excessive fees |

- |

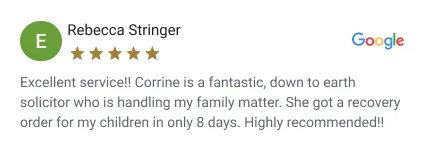

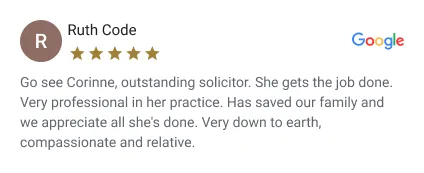

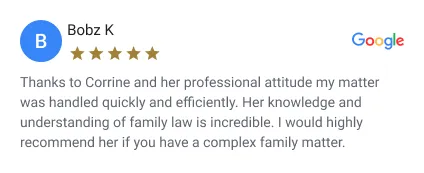

Our Clients Say It Best

The Hidden Dangers of Delaying Your Financial Settlement

The best time to begin your financial settlement is immediately after separation – you don't need to wait for divorce proceedings. and you shouldn’t.

While married couples have up to 12 months after divorce to finalise settlements and de facto couples have two years from separation, delaying can have serious consequences.

Why Acting Quickly Matters

Asset values are based on the agreement date, not the separation date. Meaning, delays can significantly impact your entitlements.

Without formal agreements, both parties can make additional financial claims even years later.

The longer you wait, the more complicated and expensive the process typically becomes.

Finalising your settlement allows you to begin building your new future without lingering uncertainty.

Let us help you secure a fair, legally binding settlement that protects your future. Contact us today.

Don’t Waste Your Precious Time—Book a Consultation Today

If you’re serious about financially separating from your ex and giving yourself a fresh start, don’t wait. We are ready to guide you through a smooth, stress-free, and amicable settlement process.

Book your “Family Separation Pathway” consultation for $165 (inc. GST) and discover:

✅ A proven roadmap for splitting your home equity, superannuation, contributions and other assets fair and square.

✅ Insider tips on how to navigate formal agreements, procedures and required paperwork for a hassle-free financial separation.

✅ How joint debts and individual debts (mortgages, loans, credit cards) will be accounted for in the overall settlement.

✅ How to craft a parenting arrangement where everybody is happy, including your children.

✅ Our transparent, fixed costs and projected timelines

✅ Answers on all your questions in plain, jargon-free language

How it Works

Book your Family Separation Pathway Consult for $165 (inc. GST)

Private, focused discussion on your situation, assets, and wishes

We’ll lay out your best options moving forward and a proven roadmap to amicable financial settlements

Walk away with a full understanding of your options, strategy, and timeline. And if you decide to move forward with us, we'll credit that $165 toward your full package.

Frequently Asked Questions

What constitutes 'property' in a settlement?

Property includes all assets and liabilities owned by either party, individually or jointly, regardless of when or how they were acquired. This covers real estate, vehicles, bank accounts, investments, crypto currencies, business interests, superannuation, household items, and debts. The property pool is valued as of the date of the agreement, not the date of separation.

What are the time limits for applying for a property settlement?

For married couples, you must apply within 12 months after your divorce becomes final. For de facto relationships, the deadline is within 2 years of separation. Missing these deadlines requires special court permission, which isn't guaranteed.

Can we reach an agreement without going to court?

Yes. Amicable settlements can be formalised through either Consent Orders (court-approved but without hearings) or Binding Financial Agreements (private contracts requiring independent legal advice). Both are legally binding and enforceable.

How is superannuation treated in a property settlement?

Superannuation is considered property but is treated differently as it's a preserved asset. It can be split between parties (either by percentage or amount), rolled over to the other person's fund, or offset against other assets. Specialised superannuation orders may be required depending on the fund.

What if we can't agree on the division of property?

If agreement isn't possible through negotiation or mediation, you can apply to the court for property orders. The court will make decisions based on the factors mentioned above. However, this path typically involves higher costs, longer timeframes, and less control over outcomes.

How long does the property settlement process take?

Timeframes vary significantly. Amicable settlements with straightforward assets can be completed in 2-3 months. Contested matters requiring court intervention may take 1-2 years or longer. Starting the process promptly after separation is strongly advised.

How are assets and debts divided?

There's no automatic 50/50 split. The division depends on the specific circumstances, including contributions throughout the relationship, future needs, and ensuring a just and equitable outcome. Both assets and liabilities are considered in the overall settlement.

Does income disparity affect the settlement?

Yes. Income differences are considered under the "future needs" assessment. A party with significantly lower earning capacity or future financial resources may receive a higher percentage adjustment to account for this disparity.

What impact does post-separation income have?

Post-separation income and assets acquired after separation but before final settlement may be included in the property pool, especially for longer separation periods. This is why finalising settlements promptly is advantageous.

What are the financial implications of infidelity?

Generally, infidelity has minimal direct impact on property settlements. The court focuses on financial and non-financial contributions and future needs rather than moral judgments about relationship conduct.

How are joint debts handled?

Joint debts remain the responsibility of both parties until formally addressed in the settlement. They can be paid off, transferred to one party with offsetting assets, or sold to eliminate the debt. The settlement should clearly specify who assumes responsibility for each debt.

Your Way to a Fair, Amicable Financial Settlement and a Clear Path Forward Starts Here

Book your “Family Separation Pathway” consultation for $165 (inc. GST) and get:

A proven roadmap for splitting assets fair and square

Insider tips on how to achieve hassle-free financial separation

Clear advice on joint debts and individual debts

Parenting arrangement strategy

Transparent, fixed costs and projected timelines

Answers on all your questions in plain, jargon-free language